How to Write a Banking Cover Letter + Examples and Templates

This complete guide with expert tips and real examples will teach you how to write a compelling cover letter — fast and stress-free!

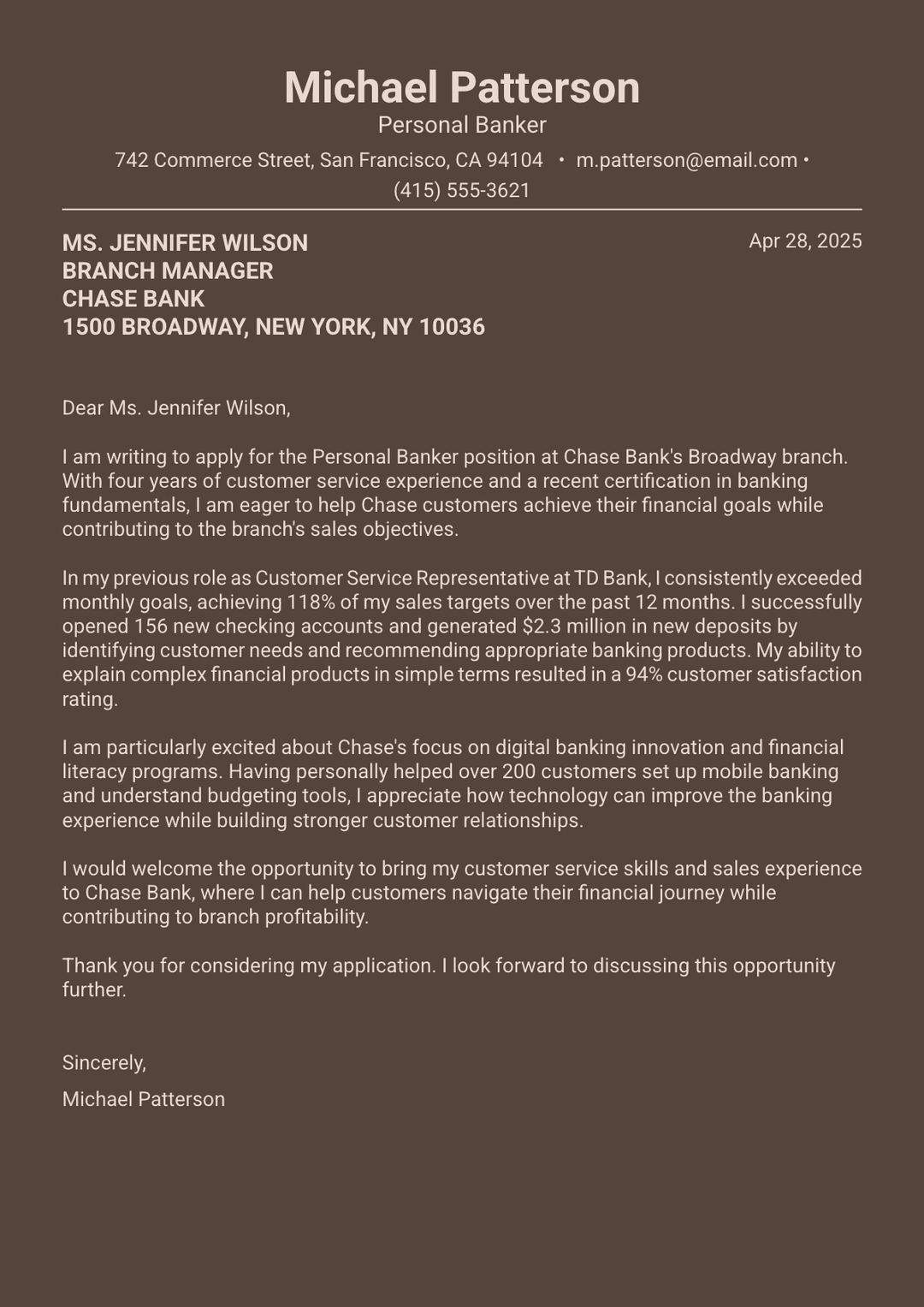

Edit this cover letter

Writing a good banking cover letter implies projecting confidence, precision, and professionalism. Banks handle billions in transactions daily and expect the same attention to detail from their employees as they apply to their financial operations. A poorly structured or impersonal cover letter raises doubts about your accuracy, communication skills, and understanding of the financial sector. You might be the perfect fit—but if your cover letter doesn’t show it, hiring managers won’t take the time to find out.

In this guide, we’ll show you exactly how to write a professional banking cover letter that demonstrates your precision, integrity, and understanding of the financial sector. Plus, we’ll share real examples and ready-to-use templates to help you create a cover letter that makes a strong impression from the very first line.

- Banking cover letters require industry-specific knowledge of financial markets, banking products, and regulatory frameworks like Dodd-Frank and Basel III.

- Quantifying achievements with specific metrics is essential—replace vague statements with concrete numbers showing impact on portfolio growth, accuracy rates, or revenue.

- Professional formatting and meticulous attention to detail are non-negotiable, as presentation errors directly reflect the precision expected in financial services.

- Different banking sectors—investment, commercial, retail, and credit unions—require tailored approaches based on their distinct client bases and business focuses.

- Career gaps or industry transitions must be addressed proactively by emphasizing transferable skills and demonstrating commitment through certifications or education.

What Makes a Banking Cover Letter Different?

Unlike standard cover letters, banking cover letters require you to showcase knowledge of financial markets, banking products, and regulatory frameworks, such as Dodd-Frank, Basel III, or consumer protection laws. Also, these letters need to highlight analytical skills, attention to detail, and the ability to work in high-pressure environments.

Furthermore, the purpose of a banking cover letter extends beyond listing qualifications. It's your opportunity to demonstrate financial acumen through specific examples and quantified achievements. Standing out from the crowd is especially important given that each year, roughly 942,500 new opportunities are projected across the business and finance industry—driven both by new job growth and the ongoing need to replace professionals who retire or move to other fields.

The table below shows the difference between good vs. bad achievement in a banking cover letter.

Streamlined loan processing procedures, reducing approval time by 18% while maintaining a 99.2% accuracy rate in documentation review.

Bad Example

Improved processes

Also, you should address any potential concerns about your background, such as gaps in employment or transitions from other industries. Provide context for your career journey and explain how your unique experience brings value to the banking sector.

Banking Cover Letter Examples by Position

To help you along the way, we’ve made a few banking cover letter examples for different positions in the financial sector to inspire your own writing and help you land an interview.

Investment Banking Cover Letter Example

Commercial Banking Cover Letter Example

Retail Banking Cover Letter Example

Bank Teller Cover Letter Example

How to Write a Banking Cover Letter in 5 Easy Steps

Writing a banking cover letter is all about combining professionalism with strategic communication. The goal is to demonstrate financial expertise, attention to detail, trustworthiness, and genuine interest in the institution.

Follow these five easy steps to create a cover letter that positions you as a confident and capable banking professional.

#1. Research the Bank and the Position

Before you even start writing, you need to research the company. Understanding the bank's culture, values, and recent developments is crucial for creating a compelling banking cover letter. Start by thoroughly reviewing the bank's website, recent press releases, and annual reports to understand their strategic priorities and market position. For example, the American Bankers Association provides excellent resources for understanding industry trends and individual bank positioning.

Next, analyze specific job requirements and preferred qualifications. Look for keywords related to required skills, software proficiency, and experience levels. Understanding whether the role focuses on client-facing activities, analytical work, or operational functions will help you tailor your message appropriately.

Also, take time to understand the bank's target market and business focus. Investment banks serve institutional clients and focus on capital markets, while commercial banks primarily serve businesses, and retail banks focus on individual consumers. Credit unions emphasize member service and community involvement. Each requires a different approach in your cover letter.

#2. Use Professional Banking Cover Letter Format

Standard business letter format is essential for banking cover letters, as it demonstrates professionalism and attention to detail. Your header should include:

- Full name

- Address

- Phone number

- Email address

The aforementioned information should be followed by the date and the recipient's information.

The proper salutation requires addressing the hiring manager by name whenever possible. If you can't find a specific name, use "Dear Hiring Manager" or "Dear [Bank Name] Recruitment Team." Avoid generic greetings like "To Whom It May Concern," which appear impersonal and outdated.

Structure your letter with three main paragraphs:

- An engaging introduction that states the position and captures attention

- A substantive body paragraph that highlights your relevant qualifications and achievements

- A confident conclusion that reiterates your interest and requests next steps

Choose appropriate fonts and spacing that reflect banking industry standards. Use professional fonts like Times New Roman, Arial, or Calibri in 11 or 12-point size. Maintain standard margins (1 inch on all sides) and single-space within paragraphs with double spacing between paragraphs.

Also, keep your cover letter length to one page, as banking professionals value efficiency. Therefore, demonstrate this quality by presenting your qualifications clearly and succinctly without unnecessary wordiness.

#3. Write a Compelling Opening Paragraph

Your opening paragraph should clearly state the position you're seeking. Mention where you found the job posting, whether through the bank's website, a job search site, or a professional referral.

Create an immediate connection by mentioning something specific about the bank or recent news that genuinely interests you. This could be a recent acquisition, new product launch, community initiative, or industry recognition that aligns with your career goals.

Provide a brief preview of your strongest banking-related qualifications without repeating everything that's on your resume. Focus on one or two key achievements or skills that directly relate to the position requirements.

Your opening should establish credibility and show enthusiasm for both the specific role and the banking industry. Avoid generic statements about wanting to work for a "leading financial institution" and instead demonstrate specific knowledge about what makes this particular bank appealing.

#4. Demonstrate Your Banking Experience and Skills

The body of your banking cover letter should focus on quantifying achievements with specific numbers and percentages that demonstrate your impact. Highlight relevant banking software experience, including core banking systems like FIS, Fiserv, or Jack Henry, as well as specialized tools like Bloomberg Terminal, Moody's Analytics, or loan origination systems. Mention CRM systems, financial modeling software, and any proprietary systems you've used.

Demonstrate knowledge of banking regulations and compliance requirements relevant to your target position. This might include BSA/AML knowledge for retail positions, SEC regulations for investment banking, or commercial lending guidelines for business banking roles.

Showcase analytical and problem-solving abilities through specific examples. Describe situations where you identified issues, analyzed data, and implemented solutions that benefited your employer or clients.

Overall, banking is ultimately about profitability, risk management, and customer satisfaction, so show how your contributions supported these objectives in measurable ways.

#5. Close with Confidence and Next Steps

Your closing paragraph should reiterate your interest and qualifications, as well as express a clear call-to-action for interview scheduling.

Thank the hiring manager for their time and consideration, then indicate your intention to follow up. Specify a timeframe, such as "I will follow up next week" or "I look forward to hearing from you within the next two weeks."

Use an appropriate sign-off for banking industry correspondence. "Sincerely," "Best regards," or "Respectfully" are all acceptable, followed by your typed name. If submitting a hard copy, leave space for your handwritten signature.

Make sure to proofread your entire letter multiple times, checking for grammar, spelling, and formatting errors. Consider having someone else review it as well, since banking positions require meticulous attention to detail.

Banking Cover Letter Template

Here’s a banking cover letter template that you can customize with your specific experience, metrics, and accomplishments.

5 Common Banking Cover Letter Mistakes to Avoid

Your banking cover letter is your first opportunity to show professionalism, precision, and industry awareness. However, even skilled applicants often make mistakes in their cover letters that weaken their message.

Here are five common errors and how to fix them to make your cover letter stand out:

- Generic content without banking focus. Language like "I'm a hard worker" or "I'm detail-oriented" without banking context fails to demonstrate industry knowledge. Banking-specific language and terminology show you understand the industry's unique challenges and requirements. Use terms like "credit analysis," "portfolio management," "regulatory compliance," and "risk assessment" when relevant to your experience and the target position.

- Failing to quantify financial achievements. Banking is all about numbers, and hiring managers expect to see quantified results in your cover letter. Saying you "improved processes" is vague, while "reduced loan approval time by 22% while maintaining 99.7% accuracy" demonstrates specific impact. Effective quantification includes portfolio sizes, transaction volumes, accuracy rates, cost savings, revenue generation, customer satisfaction scores, and compliance metrics.

- Ignoring compliance and regulatory knowledge. Mentioning relevant regulations, certification requirements, or compliance experience indicates you're prepared for banking's regulatory environment. By showing awareness of current regulatory changes or industry trends, you position yourself as informed about developments that affect banking operations and strategy.

- Poor formatting and presentation. Banking values precision and professionalism, making formatting errors particularly damaging in this industry. Common mistakes include inconsistent fonts, poor spacing, typos, grammatical errors, and unprofessional email addresses. Ensure your document looks polished and error-free, as this reflects the attention to detail expected in financial services.

- Not addressing career gaps or changes. Career transitions into banking or employment gaps require explanation. Failing to address these issues can leave questions that hurt your chances of getting an interview. Explain career transitions by emphasizing transferable skills and demonstrating commitment to banking through education, certifications, or networking activities.

Ready to Create a Winning Banking Cover Letter?

Create a compelling banking cover letter with ResumeBuilder.so. Our AI-powered cover letter builder helps you create tailored, industry-specific letters that highlight your achievements, compliance expertise, and financial acumen in minutes.

Whether you’re applying for an entry-level analyst role or a senior banking position, the platform provides customizable cover letter templates, real-world examples, and AI suggestions that align your tone and structure with top industry standards.

Final Thoughts

Writing an effective banking cover letter requires attention to details, professional presentation, and clear demonstration of relevant qualifications. The banking industry's competitive nature means your cover letter must immediately establish credibility and show genuine understanding of financial services.

Customization remains the key to success—generic letters simply don't work in banking. Also, remember that your banking cover letter works in conjunction with your resume to tell your entire career story. Therefore, ensure consistency between your cover letter and resume to secure interviews and advance your banking career.

Banking Cover Letter FAQ

#1. How long should a banking cover letter be?

A banking cover letter should be one page, typically 3-4 paragraphs (250-400 words). Conciseness and efficiency are key, so keep your letter focused on the most relevant qualifications and achievements without unnecessary elaboration.

#2. Should I mention salary expectations in my banking cover letter?

No, avoid mentioning salary expectations in your banking cover letter unless specifically requested in the job posting. Focus on demonstrating your value and qualifications instead, leaving compensation discussions for the interview stage when you have more leverage.

#3. How do I address a banking cover letter without a specific contact name?

Use "Dear Hiring Manager" or "Dear [Bank Name] Recruitment Team" when you don't have a specific contact. Avoid generic greetings like "To Whom It May Concern" as they appear less professional in the banking industry.

#4. What banking certifications should I mention in my cover letter?

Mention relevant certifications like CFA, FRM, Series 7, Series 66, or banking-specific credentials. Only include certifications that directly relate to the position you're applying for and highlight how they qualify you for the role.

#5. How do I explain a career change to banking in my cover letter?

Focus on transferable skills like analytical thinking, customer service, or financial analysis. Explain your motivation for entering banking and demonstrate knowledge of the industry through research, networking, or relevant coursework you've completed.

#6. Should I include my GPA in a banking cover letter?

Include your GPA only if you're a recent graduate (within 2-3 years) and it's 3.5 or higher. If you’re an experienced professional, focus on work achievements and relevant experience rather than academic performance.