Financial Analyst Resume: Examples and Writing Guide for 2025

This complete guide with detailed explanations and expert tips will teach you how to write an acting resume in record time!

Edit this resume

A financial analyst resume needs to demonstrate both your technical skills and your ability to turn numbers into business insights. With hundreds of candidates competing for every position, your resume has to make an impression before it's tossed aside. However, most financial analyst resumes look exactly the same. They list duties instead of achievements, bury important skills in generic text blocks, and fail to pass the automated systems screening them.

To help you avoid all of these pitfalls, we’ve created this guide to show you how to write your financial analyst resume with real-world examples and actionable strategies. Whether you're fresh out of college or striving for a senior role, you'll learn how to showcase what makes you different.

Key Takeaways

- A strong financial analyst resume highlights both technical expertise and the ability to turn complex data into actionable business insights, not just a list of responsibilities.

- Using the right resume format—typically reverse-chronological—helps showcase career progression clearly and improves your chances of passing ATS screening.

- Quantifiable achievements are essential; metrics like cost savings, portfolio performance, or revenue impact make your experience more credible and compelling.

- Technical skills such as financial modeling, Excel, SQL, and BI tools should be clearly listed and tailored to the job description, with soft skills demonstrated through accomplishments.

- ATS optimization, i.e., clean formatting, standard headings, relevant keywords, and compatible file formats, is critical to ensuring your resume is actually seen by a human recruiter.

What Does a Financial Analyst Do?

A financial analyst evaluates financial data, prepares reports, and provides recommendations to help organizations make informed business decisions. These professionals dig into financial statements, spot trends that others miss, and translate complex data into insights that executives can actually use. According to the U.S. Bureau of Labor Statistics, with a median annual salary of $101,910, financial analysts can expect a stable job outlook, growing at 6% over the next decade.

Career progression typically follows a clear path. You start as a junior or entry-level analyst, move up to analyst, then senior analyst, and eventually into a finance manager or director role. As your career advances, the focus shifts toward strategic thinking, leadership, and business impact.

5+ Financial Analyst Resume Examples

Financial analyst resume examples demonstrate how to effectively present your experience, skills, and achievements for different career levels and specializations, showing the format and content that actually gets results. Let’s some real-world resume examples by career level:

Entry-Level Financial Analyst Resume Example

Mid-Level Financial Analyst Resume Example

Senior Financial Analyst Resume Example

Investment Analyst Resume Example

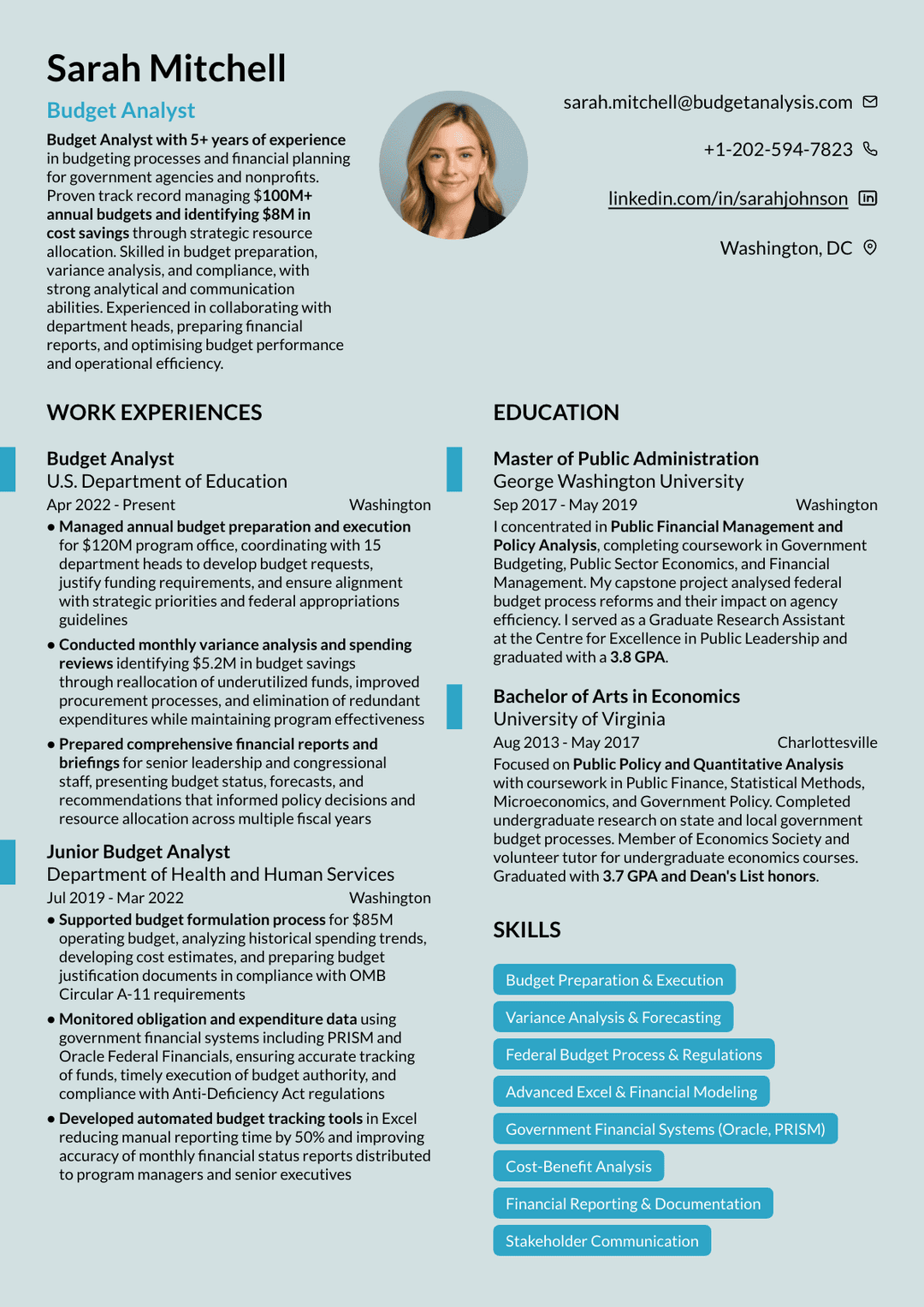

Budget Analyst Resume Example

Credit Analyst Resume Example

How to Write a Financial Analyst Resume: Step by Step Guide

Writing a financial analyst resume means including all the relevant sections, such as your contact information, professional summary, work experience with quantifiable achievements, education, technical skills, certifications, and any additional sections that strengthen your candidacy. Presentation matters, so it’s important to choose the correct resume format first.

Now, let's break down each step of the resume writing process to help you create one that really stands out.

#1. Choose the Right Resume Format

There are three main resume format options you can choose for your financial analyst resume:

- Reverse-chronological format. This one is your best bet if you've got consistent finance experience. It lists your work history starting with your most recent position and working backward. Hiring managers love this format because it clearly shows career progression and relevant experience. This is the gold standard for most financial analyst candidates.

- Functional format. It emphasizes skills over work experience. This format works if you're changing careers and bringing transferable skills from another field—maybe you were an engineer who did lots of data analysis. However, some recruiters find functional resumes suspicious, wondering what you're trying to hide.

- Hybrid/combination format. This one blends skills and experience, giving you the best of both worlds. It's useful for mid-level analysts who want to highlight both their technical capabilities and their career progression. You lead with a robust skills section, then follow with detailed work experience.

#2. Provide Correct Contact Information

After you’ve chosen the resume format, it’s time to start writing. Even though this seems obvious, many people mess up the contact information section. Make sure to include your:

- Full name

- Location (city and state)

- Phone number

- Professional email address (firstname.lastname@email.com)

- Linkedin profile

If you've built a portfolio website showcasing financial models or analysis projects, include that too.

Here’s a good example:

SARAH JOHNSON, CFA

New York, NY

(212) 555-0234

sarah.johnson@email.com

linkedin.com/in/sarahjohnsoncfa

#3. Craft a Professional Summary or Objective

This is where entry-level and experienced candidates diverge. If you've got 3+ years, write a professional summary highlighting your experience, specializations, and top achievements. On the other hand, if you’re an entry-level candidate, use an objective statement explaining career goals and what you bring to the table.

That said, let’s see a good example of professional summary and objective statements:

Results-driven Senior Financial Analyst with 7+ years of experience in corporate FP&A and strategic planning. Expert in financial modeling, budgeting, and forecasting with a proven track record of driving $25M+ in cost savings and revenue optimization. Skilled at translating complex financial data into actionable insights for executive leadership. CFA charterholder with deep expertise in financial analysis and valuation.

Recent finance graduate with strong foundation in financial modeling, data analysis, and investment valuation. Completed internship analyzing $10M portfolio with 94% forecast accuracy. CFA Level I candidate eager to apply analytical skills to support data-driven business decisions at a growth-focused organization.

#4. Add Your Work Experience

The work experience section is where most candidates fail. The important thing is to list your positions in reverse-chronological order (most recent first), and quantify your achievements. To achieve this, it+s best to use the STAR method: situation (context), task (your responsibility), action (what you did), result (quantifiable outcome).

Here’s what a well-written work experience entry looks like:

Financial Analyst | Tech Growth Company | March 2017 - December 2019

- Built driver-based financial model used for Series C fundraising, supporting successful $75M raise at favorable valuation

- Analyzed unit economics and identified 3 key metrics that became primary KPIs for company strategy, now tracked in weekly executive meetings

- Reduced SG&A spend by $4.2M annually through zero-based budgeting initiative and vendor cost optimization

#5. List Your Education and Skills

As for education on resume, make sure to list the following information:

- Degree(s)

- Institution

- Graduation date

If you’re a recent graduate, include relevant coursework, honors, GPA if it's 3.5 or higher, and academic projects related to financial analysis. Once you've been working for 3+ years, you can drop the GPA and coursework as your work experience speaks louder.

Let’s see a good example of education on resume:

EDUCATION

Master of Business Administration (MBA) | Columbia Business School | 2017

Bachelor of Science in Finance | New York University | 2015

Skills on a resume shouldn’t be buried in a paragraph. Divide into technical skills (e.g. Excel, Python, SAP) and soft skills (communication, problem-solving). The key is being specific, for example:

SKILLS

- Financial Analysis and Modeling

- Financial statement analysis, DCF valuation, scenario modeling, budget variance analysis, forecasting, sensitivity analysis

- Technical Proficiency

- Advanced Excel (pivot tables, VLOOKUP, macros, VBA), SQL, Python, Power BI, Tableau, Bloomberg Terminal, SAP, QuickBooks

- Accounting and Finance

- GAAP principles, balance sheet reconciliation, cash flow analysis, cost-benefit analysis, financial reporting

- Analytical and Problem-Solving

- Critical thinking, data interpretation, identifying trends and anomalies, root cause analysis, strategic recommendations

- Communication and Collaboration

- Presenting complex financial data to non-finance stakeholders, cross-functional teamwork, executive reporting, stakeholder management

- Project and Time Management

- Managing multiple priorities, meeting tight deadlines, leading financial projects, process improvement initiatives

#6. Include Additional Sections

Additional resume sections for financial analysts can include professional affiliations, technical projects, publications, languages, and volunteer experience that strengthen your candidacy by demonstrating commitment to the profession and well-rounded capabilities.

Professional Affiliations

Membership in finance organizations shows professional engagement and commitment to staying current in the field:

- CFA Institute and local CFA societies

- Financial Planning Association (FPA)

- American Finance Association

- National Association of Business Economics

If you're actively involved (committee member, event volunteer, conference attendee), mention it. Active participation carries more weight than just paying membership dues.

Technical Projects

Particularly valuable for entry-level candidates who need to demonstrate skills beyond coursework. Include personal or academic projects showing financial analysis capabilities:

- Portfolio optimization models you built

- Financial statement analysis projects with real companies

- Investment simulations or trading competitions

- Business valuation exercises for actual or hypothetical companies

- Financial dashboards or tools you created

Briefly describe the project, tools used, and key findings or results. If you've published the project on GitHub or a personal website, include the link.

Publications and Presentations

Any finance-related articles, research papers, or conference presentations add credibility and demonstrate thought leadership. Include the publication name, date, and link if available online.

Languages

These are important for multinational corporations or roles involving international markets. Specify proficiency level honestly—fluent, proficient, conversational, or basic. For example, Spanish, Mandarin, French, and German are particularly valuable in global finance roles. However, don't inflate your language skills; you might get tested in an interview.

#7. Optimize for ATS Systems

Applicant Tracking Systems (ATS) scan your resume for keywords, proper formatting, and relevant experience. If your resume isn't ATS-friendly, you're essentially submitting your application into a black hole.

Make your resume ATS-compliant with the following tips:

- Use standard section headings like "Work Experience," "Education," "Skills"—not creative alternatives like "My Journey" or "What I Bring"

- Include relevant keywords from job descriptions (but don't just copy-paste; make them authentic to your experience)

- Avoid graphics, images, tables, and multi-column layouts that confuse ATS parsers

- Save as .docx or PDF (check the job posting for preference)

- Stick with standard fonts like Arial, Calibri, Times New Roman, or Helvetica

- Don't use headers or footers for important information

- Spell out acronyms at least once: "Certified Financial Analyst (CFA)"

Top Skills to Include on Your Financial Analyst Resume

The most important skills for a financial analyst resume include technical abilities like financial modeling and Excel, and soft skills like communication and problem-solving that help you translate analysis into actionable business insights.

Technical Skills for Financial Analysts

Technical skills are your bread and butter. These are the hard skills that get your resume past ATS systems:

- Financial modeling and forecasting: Building DCF models, scenario analysis, sensitivity testing, and long-range financial projections

- Data analysis tools: Advanced Excel (pivot tables, VLOOKUP, INDEX-MATCH, macros, Power Query), SQL for database queries, Python or R for statistical analysis

- Financial software: SAP, Oracle Financials, Bloomberg Terminal, FactSet, Capital IQ, QuickBooks for accounting

- Business intelligence tools: Tableau, Power BI, Looker for creating dashboards and data visualizations that executives actually understand

- Accounting principles: Strong grasp of GAAP and IFRS standards, understanding how transactions flow through financial statements

- Statistical analysis: Regression analysis, variance analysis, hypothesis testing, correlation studies

- Financial statement analysis: Reading and interpreting P&L statements, balance sheets, cash flow statements, identifying trends and anomalies

- Budgeting and planning: Variance analysis, budget preparation, rolling forecasts, what-if scenario modeling

- Valuation techniques: Comparable company analysis, precedent transactions, sum-of-the-parts valuation

- Risk assessment: Credit risk analysis, market risk evaluation, sensitivity analysis for key business drivers

Soft Skills for Financial Analysts

Technical skills get you in the door, but soft skills help you advance, especially in the age of artificial intelligence. For instance, a study analyzing over 1,000 occupations and 70 million job transitions found that workers with strong foundational skills—like communication, basic math, and teamwork—advanced faster, earned more, and adapted better to change.

That said, here is a list of key skills you should include on your financial analyst resume:

- Analytical thinking

- Attention to detail

- Communication

- Collaboration

- Time management

- Critical thinking

Common Mistakes to Avoid on Financial Analyst Resumes

Here’s a short overview of four common financial analyst resume mistakes and how to avoid them:

| Mistake | What to Do |

|---|---|

Lack of Quantifiable Results | Always include numbers, scope, and outcomes. |

Ignoring Technical Skills | ATS and hiring managers look for specific tools and proficiency levels. Create a dedicated skills section. |

Poor Formatting | Inconsistent or cluttered formatting signals poor attention to detail. Use clean, consistent design. |

Create a Winning Financial Analyst Resume With ResumeBuilder.so

Create an ATS-optimized financial analyst resume in minutes with ResumeBuilder.so's intelligent resume builder. Choose from professionally designed resume templates tailored for finance roles that highlight your modeling skills, technical proficiency, and achievements.

Generate matching cover letters that seamlessly align with your resume content and the specific job requirements. No more formatting headaches or guesswork—just clean, professional documents that showcase your financial expertise.

Final Thoughts

Creating a standout financial analyst resume doesn't have to be complicated. Focus on what really matters. Quantify your achievements with real numbers, showcase your technical skills upfront, and make sure your resume can actually get past those ATS filters. Take the time to tailor each application—yes, it's extra work, but spending 15 minutes customizing your resume for each role makes a huge difference in your response rate.

Keep your formatting clean and professional. Finance is a pretty conservative field, so save the creative designs for other industries. Your goal is to make it as easy as possible for recruiters to see why you're the right fit. With these principles in place, you'll have a resume that opens doors and gets you those interviews you're after.

Financial Analyst Resume FAQ

#1. What should I put on my resume for a financial analyst position?

For a financial analyst resume, you should include your contact information, professional summary, relevant work experience with quantified achievements, education, technical skills, certifications, and any additional relevant sections like professional affiliations.

#2. How do I write a financial analyst resume with no experience?

To write a financial analyst resume with no experience, emphasize your education, relevant coursework, academic projects, internships, transferable skills, and certifications like CFA Level I candidate status.

#3. What skills should a financial analyst put on a resume?

Financial analysts should include technical skills like Excel, financial modeling, SQL, data visualization tools, and soft skills like analytical thinking, attention to detail, and communication on their resumes.

#4. How long should a financial analyst resume be?

A financial analyst resume should be one page for entry-level candidates with less than 5 years of experience, and can extend to two pages for senior analysts with extensive relevant experience and achievements.

#5. Should I include my GPA on my financial analyst resume?

You should include your GPA on a financial analyst resume if you're a recent graduate (within 2-3 years) and your GPA is 3.5 or higher, as it demonstrates strong academic performance.

#6. How do I showcase financial modeling skills on my resume?

To showcase financial modeling skills on a resume, include specific examples in your work experience showing types of models built (DCF, LBO, merger models), business impact of your models, and technical tools used. Use bullet points to describe models you created and their outcomes.

#7. Should I include Excel skills on my financial analyst resume?

Yes, you should include Excel skills on your financial analyst resume, specifying your proficiency level and listing advanced functions like VLOOKUP, pivot tables, macros, Power Query, and VBA if applicable.

#8. What certifications look best on a financial analyst resume?

The most impressive certifications for financial analyst resumes include the CFA (Chartered Financial Analyst), CPA (Certified Public Accountant), FRM (Financial Risk Manager), and specialized certifications like FMVA (Financial Modeling & Valuation Analyst).

#9. How do I tailor my financial analyst resume for ATS?

To tailor your financial analyst resume for ATS, use standard section headings, include relevant keywords from the job description, avoid complex formatting like tables and graphics, and save in ATS-friendly formats like .docx or PDF.

#10. Should I use a resume template for my financial analyst application?

Yes, using a professional resume template for financial analyst applications ensures proper formatting, ATS compatibility, and a polished appearance that meets industry standards while saving time.